what is the sales tax on cars in south dakota

Motor vehicles exempt from the motor vehicle excise tax under. With local taxes the total sales tax rate is between 4500 and 7500.

Gmc Yukon 2020 Black Gmc Yukon Gmc Yukon Xl 2018 Gmc Yukon

Maximum Local Sales Tax.

. Initiated in 1986 to help subsidize bridge and highway maintenance you pay the South Dakota wheel tax when you are registering your vehicle with the South Dakota Department of Revenue DOR. Average Local State Sales Tax. No paper title will be printed while there is a lien noted unless one of the exceptions in South Dakota law apply.

What is the sales tax rate in Aberdeen South Dakota. SDL 32-5-2 are also exempt from sales tax. Get 1st Month Free.

South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles. South Dakota State Sales Tax. This is the total of state county and city sales tax rates.

Get Your First Month Free. South Dakotas sales tax rates for commonly exempted items are as follows. Ad Put Your Sales Tax On Autopilot.

The highest sales tax is in Roslyn with a combined tax rate of 75 and the lowest rate is in Buffalo and Shannon Counties with a combined rate of 45. 31 rows The state sales tax rate in South Dakota is 4500. The South Dakota sales tax rate is currently.

For additional information on sales tax please refer to our Sales Tax Guide PDF. This means that an individual in the. The South Dakota sales tax rate is 4 as of 2022 with some cities and counties adding a local sales tax on top of the SD state sales tax.

Did South Dakota v. Imagine that your monthly lease payment is 500 and your states sales tax on a leased car is 6. In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

This includes the following see. Just enter the five-digit zip code of the. Though you can find automotive offerings spread out in smaller towns you may have to drive into.

If purchased in South Dakota an ATV is subject to the 4 motor vehicle excise tax. 500 X 06 30 which is. Your businesss gross revenue from sales into South Dakota exceeded 100000.

They are Delaware Montana New Hampshire Alaska and Oregon. The average sales tax rate on vehicles across the state is. Municipalities may impose a general municipal sales tax rate of up to 2.

Car Dealership Areas In South Dakota. Select the South Dakota city from the. Alabama Georgia Hawaii New York Missouri and Wyoming all at 4.

This page discusses various sales tax exemptions in South Dakota. The County sales tax rate is. In South Dakota an ATV MUST be titled.

The state sales and use tax rate is 45. What is South Dakotas Wheel Tax. South Dakota has recent rate changes Thu Jul 01 2021.

Only some SD counties. South Dakota has a statewide sales tax rate of 45 which has been in place since 1933. The South Dakota Department of Revenue administers these taxes.

They may also impose a 1 municipal gross receipts tax MGRT that is in addition to the municipal sales tax. The minimum combined 2022 sales tax rate for Aberdeen South Dakota is. Maximum Possible Sales Tax.

Municipal governments in South Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 65 across the state with an average local tax of 1817 for a total of 6317 when combined with the state sales tax. The municipal gross receipts tax can be imposed on alcoholic beverages eating establishments. Several examples of of items that exempt from South Dakota sales tax are prescription medications farm machinery advertising services replacement parts and livestock.

Fast Easy Tax Solutions. - All sales of vehicles by auction are subject to either sales or use tax or motor vehicle excise tax unless exempt under. Different areas have varying additional sales taxes as well.

In addition for a car purchased in South Dakota there are other applicable fees including registration title and plate fees. However if purchased by an out of state business you will need to show proof of tax paid to your local Department of Revenue office. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services.

States with sales tax below 5 are Colorado at 29. There are a total of five states with no sales tax. South Dakota law requires any business without a physical presence in South Dakota to obtain a South Dakota sales tax license and pay applicable sales tax if the business meets one or both of the following criteria in the previous or current calendar year.

Sales tax for a leased vehicle is calculated based on the states tax percentage and the cost of the lease payments. Stress Free Hassle Free Sales Tax. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Ad Find Out Sales Tax Rates For Free. The rest are South Dakota and Oklahoma at 45 and North Carolina at 475. The vehicle is exempt from motor vehicle excise tax under SDCL 32-5B-2.

The South Dakota Motor Vehicle Division has an Electronic Lien Title System ELT which allows lienholders to reduce the handling storage and mailing costs of paper titles by replacing them with an electronic version. While the South Dakota sales tax of 45 applies to most transactions there are certain items that may be exempt from taxation. The Aberdeen sales tax rate is.

The SD sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction. Sales Tax Exemptions in South Dakota. South Dakota has a 45 statewide sales tax rate but also has 290 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1817 on.

All car sales in South Dakota are subject to the 4 statewide sales tax. In South Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. As the name implies you pay a certain amount for each tire depending on your vehicles weight class and county.

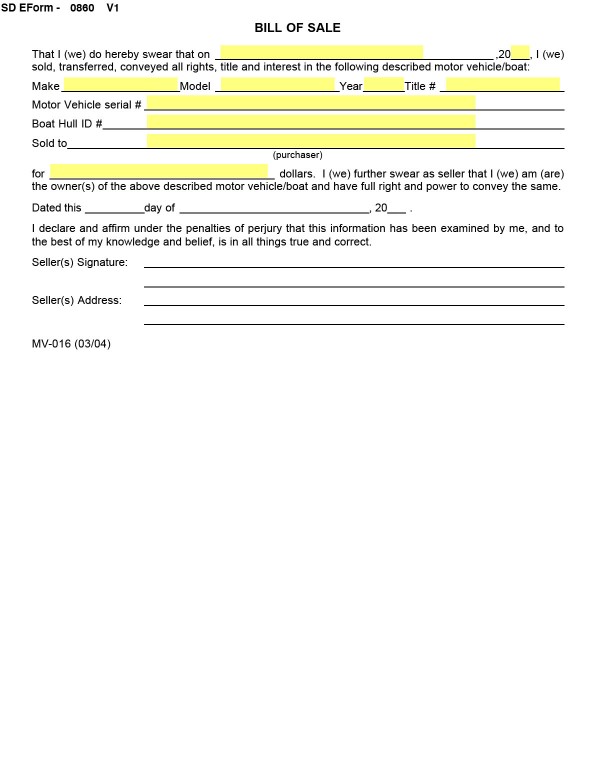

What You Need When Selling Your Vehicle To A Private Party South Dakota Department Of Revenue

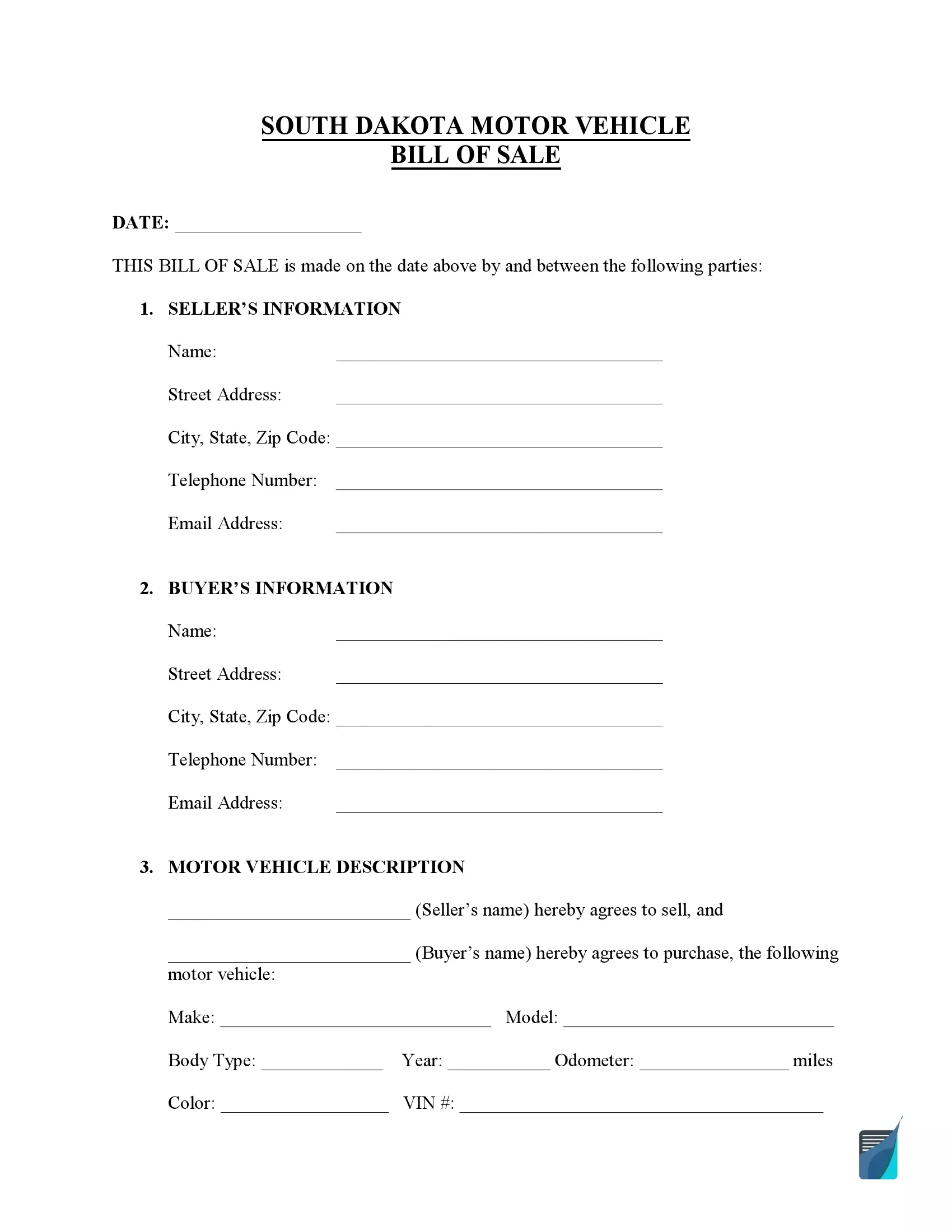

South Dakota Motor Vehicle Bill Of Sale Form Download The Free Printable Basic Bill Of Sale Blank Form Tem South Dakota Bill Of Sale Car Bill Of Sale Template

Powerball Results And Numbers For 3 17 21 As Jackpot Was An Estimated 184m

Bills Of Sale In South Dakota The Forms And Facts You Need

Sales Tax Software Market To Set Remarkable Growth By 2025 Leading Key Players Avalara Vertex Sovos Egov Systems Tax Software Marketing Trends Trends Map

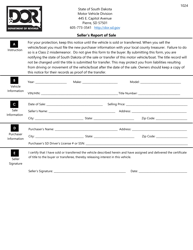

Form 1024 Download Printable Pdf Or Fill Online Seller S Report Of Sale South Dakota Templateroller

What S The Car Sales Tax In Each State Find The Best Car Price

Sales Tax On Cars And Vehicles In South Dakota

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Free South Dakota Vehicle Bill Of Sale Form Pdf Formspal

Form 1024 Download Printable Pdf Or Fill Online Seller S Report Of Sale South Dakota Templateroller

Yes You Can Stop A Trustee Sale Sheriff Sale Or Foreclosure Eviction Asap Do Land Patent Updates And Deed Acknowledgment Too Get Help Yes You Can Stop A Trustee

Car Buyers Beware Cheapest And Most Expensive States For Unexpected Fees

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Pin By Garik Kumednyj On Fj40 47 Toyota Fj40 Toyota Land Cruiser Land Cruiser

Pin By Dylan On Rv Life Rv Life

What S The Car Sales Tax In Each State Find The Best Car Price